Puma AIM Inheritance Tax Service

Open for investment

£230m

Total Assets Under Management

£100m

Assets Under Management on platform

Celebrating 10 years

The Puma AIM Inheritance Tax Service (the Service) is a multi-award winning service established in the market for over 10 years.

This discretionary portfolio service seeks to grow your money over the long term, mitigating your inheritance tax liability. We endeavour to make this possible by investing in carefully selected companies quoted on AIM that qualify for Business Relief.

The Service has delivered good returns for investors over the long-term, as highlighted in our performance tables below. We do this by investing in quality companies with sustainable margins, good returns and a track record of cash generation.

Six key reasons why

We know that investing for long-term tax planning is important in helping you to achieve your financial goals. Scroll through the reasons to consider the Service.

Useful guide

We've written a guide to help you navigate Inheritance Tax, along with the benefits of Business Relief.

It covers the Service in detail with a clear case study to bring it all to life. We also explain our approach to how we choose the companies we invest in, as part of our investment portfolio.

Investing with us, through a Financial Adviser

All fees are inclusive of VAT where applicable.

INITIAL FEE

1%

of amount subscribed

ANNUAL MANAGEMENT FEE

1.5%

of portfolio value

DEALING FEE

1%

applied to the purchase and sale of stocks

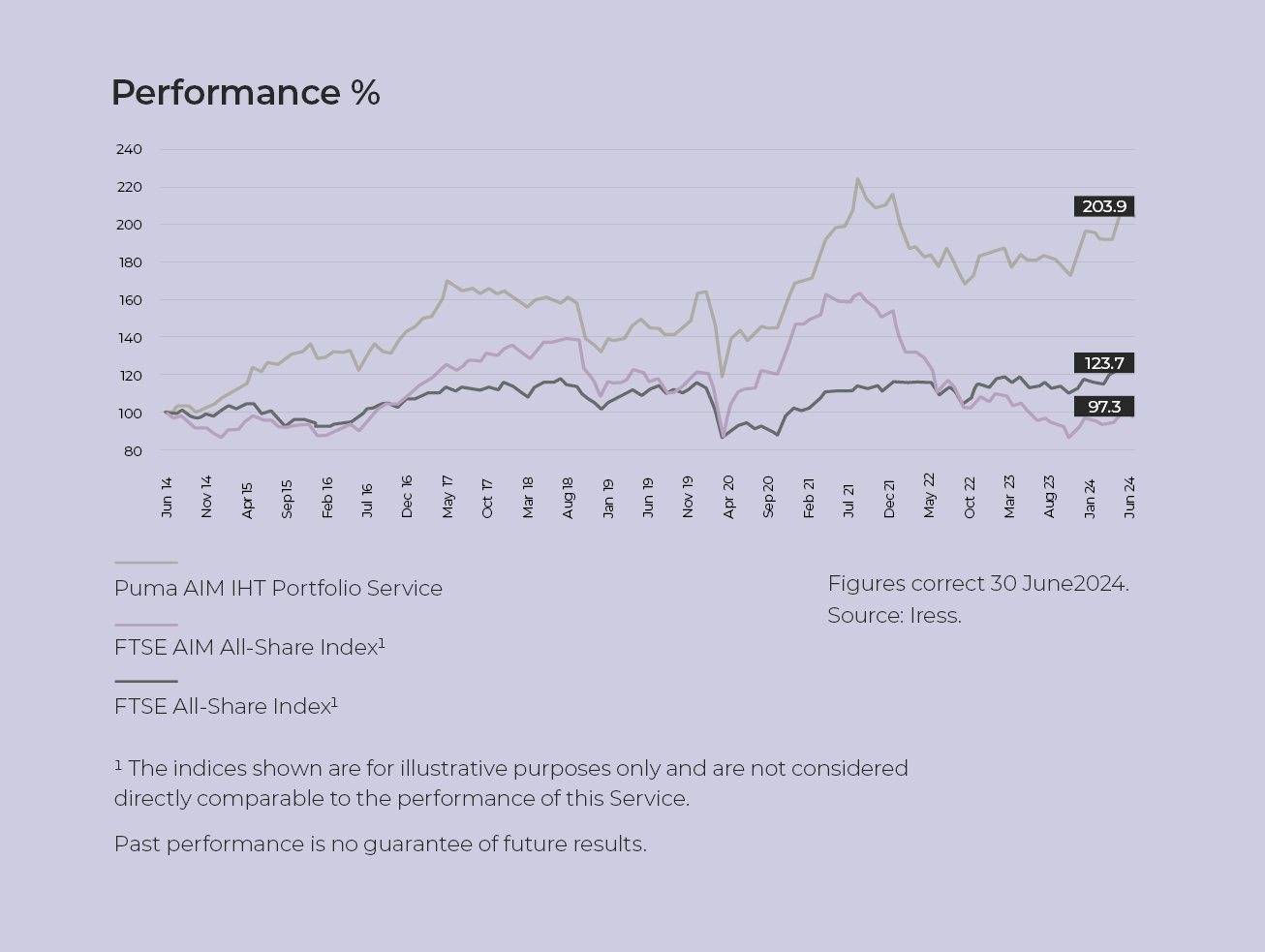

Performance in more detail

NAV performance for growth shares since inception

Compound Annual Growth Rate

Cumulative performance since inception

Source: Iress

Figures correct 30 June 2024

Cumulative investment performance %

| Index | 3 MONTHS | 1 YEAR | 3 YEARS | 5 YEARS | SINCE INCEPTION |

| Puma AIM IHT Portfolio Service | +5.58 | +12.26 | +2.06 | +40.01 | +103.92 |

| FTSE AIM All-Share Index (AXX)1 | +2.84 | +1.44 | -38.77 | -16.85 | -2.68 |

| FTSE All-Share Index (ASX)1 | +2.62 | +8.68 | +10.89 | +9.74 | +23.66 |

Discrete investment performance %

| Index | 2023 | 2022 | 2021 | 2020 | 2019 | CAGR2 |

| Puma AIM IHT Portfolio Service | +5.72 | -14.24 | +28.39 | +2.81 | +24.23 | +7.38 |

| FTSE AIM All-Share Index (AXX)1 | -8.18 | -31.69 | +5.17 | +20.74 | +11.61 | -0.27 |

| FTSE All-Share Index (ASX)1 | +3.85 | -3.16 | +14.55 | -12.46 | +14.19 | +2.15 |

Discrete performance data is calculated as full-year periods from 1 January to 31 December of the year displayed.

1 The indices shown are for illustrative purposes only and are not considered directly comparable to the performance of this Service. Source: Iress.

2 Compound Annual Growth Rate.

Please note that performance data applies to the longest held, live portfolio which has been invested since inception, based on a portfolio managed directly by the Manager on its main trading platform. Performance data may vary for portfolios managed by the Manager on platform due to differing deal fees and other platform fees. Furthermore, small variations in performance may apply as each individual investor has their own discrete portfolio of assets. Discrete performance data is calculated as full-year periods from 1 January to 31 December of the year displayed. Past performance is no guarantee of future results. Date of inception: 1 July 2014.

Risk factors

An investment in the Puma AIM Inheritance Tax Service may not be suitable for all investors.

An investment in the Service carries risk and you should take your own independent advice. You should only invest in the Service on the basis of the Investment Details and Investor Agreement which details the risks of the investment. Below are the key risks of the Service:

Tax reliefs are not guaranteed: Tax rules may change, which could affect the reliefs available for IHT purposes. Tax reliefs are subject to an individual’s personal circumstances and independent tax advice should be taken. While the Tax Adviser will also carry out an annual review of the portfolio, we can’t guarantee that all portfolio investments will qualify for BR. If a company should be non-qualifying at the time of being selected for the portfolio or become non-qualifying thereafter, then any applicable BR could be reduced accordingly.

Long-Term investment: An investment in the Puma AIM Inheritance Tax Service should be considered a long-term investment.

Capital at risk: The value of investments can go down as well as up, so investors may not receive their full amount invested. An investment in smaller companies is likely to be higher risk than many other investments. Companies quoted on AIM are likely to be more risky and have less rigorous listing requirements than companies quoted on the main list of the London Stock Exchange. Dealing costs may be significant, particularly in respect of a relatively small investment in the Service.

Past performance: The past performance of the Puma AIM Inheritance Tax Service, Puma Investments, the funds Puma Investments manages or the companies it advises, is not a reliable indicator of future performance. Future performance may be materially different from past results. There is no guarantee that can be given as to the overall performance or level of return that can be achieved from investments made, or that the objectives of the Service will be achieved.

Potentially illiquid investment: AIM stocks are largely small and illiquid. They are characterised by significant spreads and low trading volumes. A sale of such shares may be difficult, slow and only achievable at lower than indicated market price.

Figures on this page are taken from Puma Investments and are correct as of 30 June 2024 unless stated otherwise.