Introducing the new Puma AIM VCT

Open for investment

0%

initial fee before 20 December 2024

The first AIM VCT in 17 years

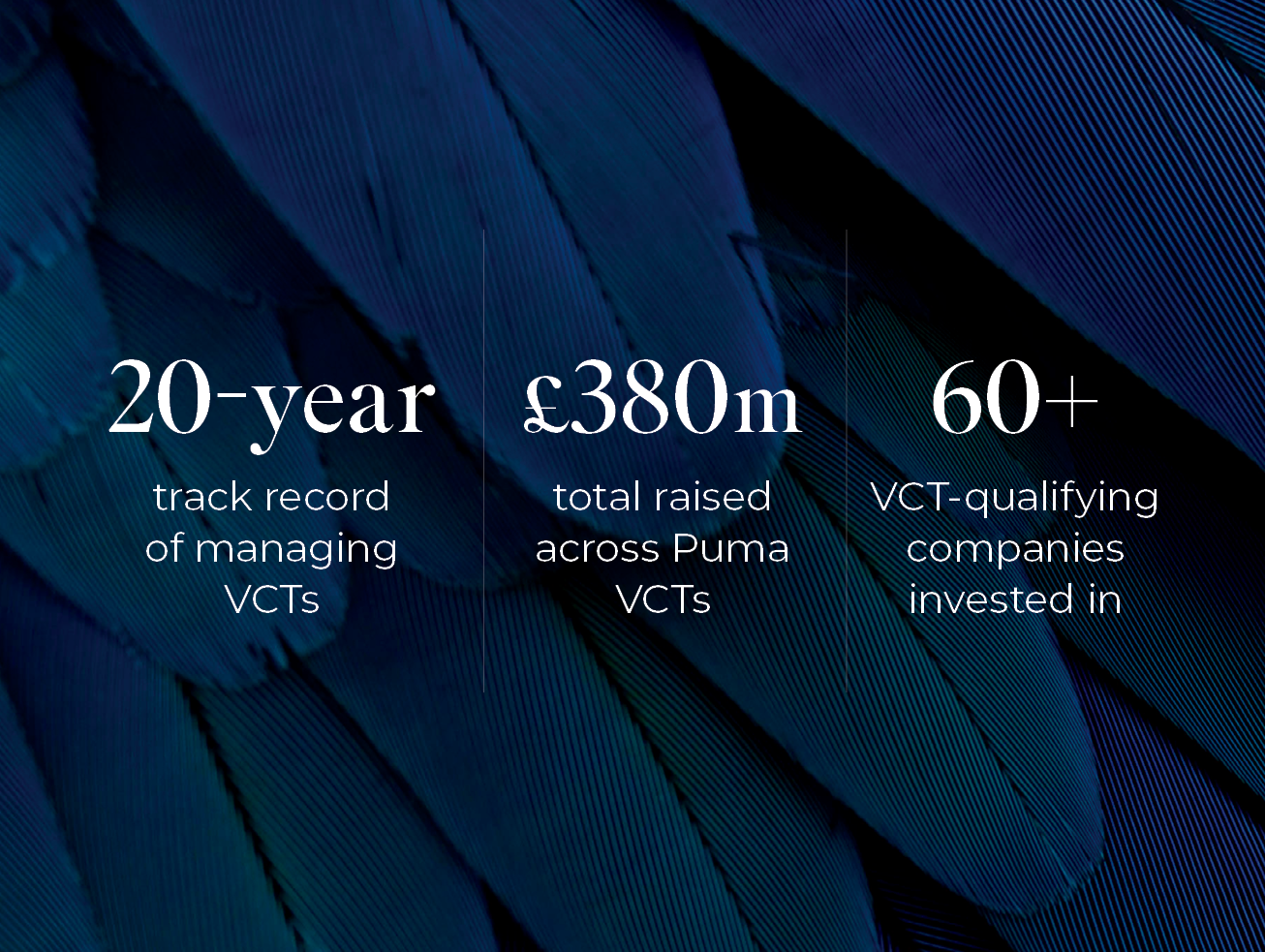

We are excited to announce the launch of the Puma AIM VCT, the first new AIM VCT to the market in 17 years. The launch reflects valuable feedback from our adviser and wealth management community.

Puma AIM VCT aims to provide you with attractive returns by investing in established companies traded on the Alternative Investment Market (AIM), offering the full range of VCT tax reliefs. We focus on stable returns from companies with growth potential, avoiding the volatility of start-ups.

Launch offer: 0% initial fee

To celebrate the launch, we are offering all investors, who apply on or before 20 December 2024, a 0% initial fee.

Six key reasons

Investing for long-term tax planning is essential to helping you achieve your financial goals. Scroll through the reasons to invest the new Puma AIM VCT.

Meet our expert team

Dr Stuart Rollason

Investment Director

Daniel Cane

Investment Director

Joseph Cornwall

Investment Manager

Fees and charges

All fees are inclusive of VAT where applicable. Please refer to the fees and charges summary in the Investment Overview for more information.

INITIAL FEE

0%

of amount subscribed, for investors who apply on or before 20 December 2024

ANNUAL MANAGEMENT FEE

2%

of net asset value pa

PERFORMANCE FEE

20%

of the investment gain within the portfolio net of costs, after first achieving a high-water mark of 110p per share

ADMINISTRATIVE FEE

0.35%

of net asset value pa

Latest company announcements

Where to next?

Investment Overview

Read our Investment Overview to learn about Puma AIM VCT in more detail.

OPEN OVERVIEW

Our guide to VCTs

Read our guide to learn more about the tax benefits of investing in a VCT.

READ GUIDE

We're here to help

Our expert team are always available to discuss this new product in more depth with you.

Risk factors

An investment in Puma AIM VCT carries risk and may not be suitable for all investors. Investors can only invest in Puma AIM VCT on the basis of the prospectus which details the risks of the investment. Below are the key risks:

Tax reliefs: Tax reliefs are not guaranteed, depend on individuals’ personal circumstances and a five-year minimum holding period, and may be subject to change.

Liquidity: It is unlikely there will be a liquid market in the ordinary shares of Puma AIM VCT and it may prove difficult for investors to realise their investment immediately or in full.

Capital at risk: An investment in Puma AIM VCT involves a high degree of risk. Investors’ capital may be at risk.

General: Past performance of Puma Investments in relation to its other VCTs is no indication of future results. The payment of dividends is not guaranteed. Investors have no direct right of action against Puma Investments. The Financial Ombudsman Service/the Financial Services Compensation Scheme are not available.

Figures on this page are taken from Puma Investments and are correct as of 31 August 2024 unless stated otherwise.

Sources

For all performance data: Puma Investments. Figures correct at 31 August 2024 and may be subject to rounding errors.

1 Gov.uk, Business population estimates for the UK and regions, 2022.